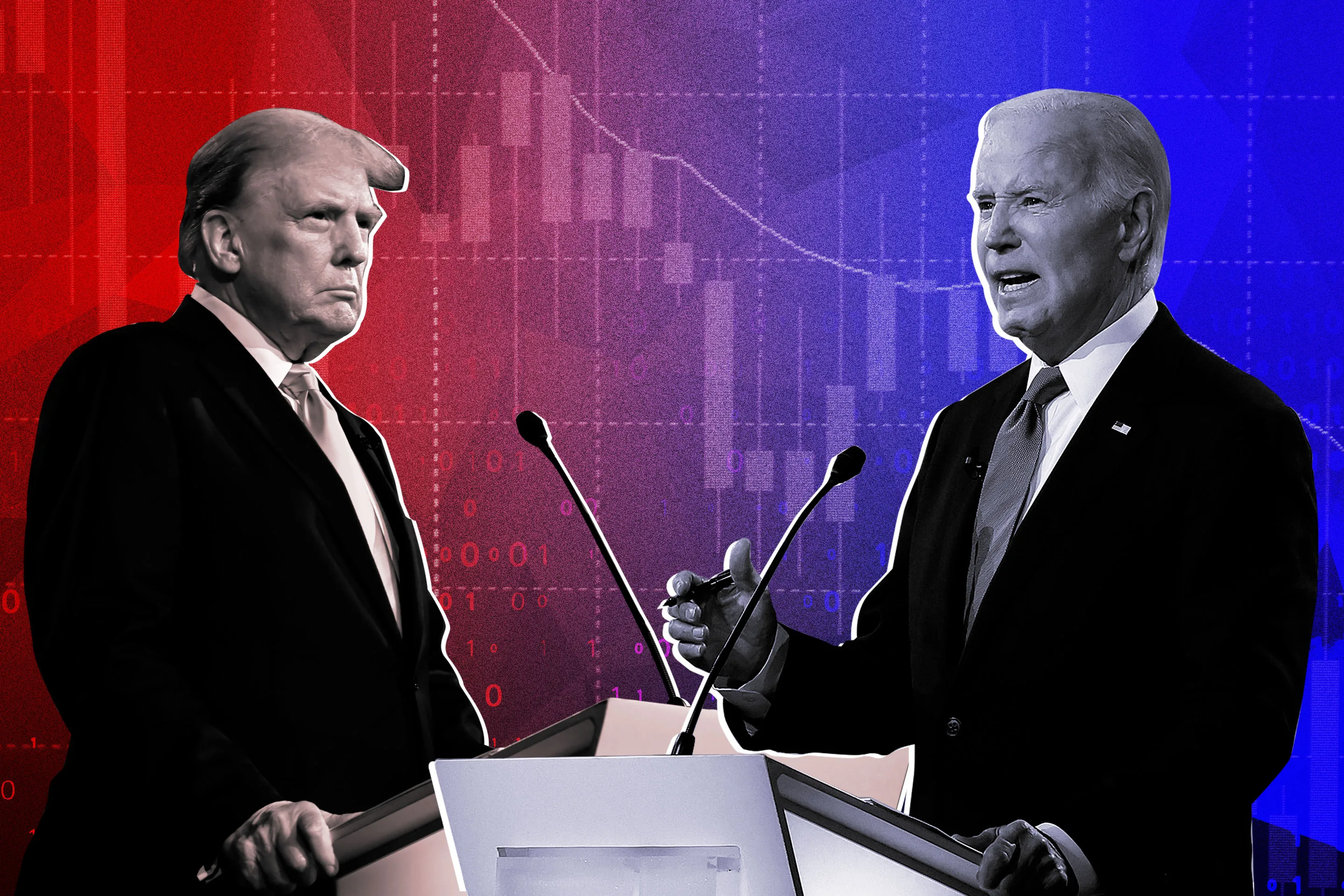

Beneath the blather and accusations on the first 2024 presidential debate, cash took middle stage Thursday in Atlanta. President Joe Biden and former President Donald Trump confronted off on subjects together with however not restricted to Social Safety, taxes, the price of little one care, housing affordability, inflation, jobs, tariffs, Pell Grants and the value of eggs.

(Whew.) (It was a lengthy 90 minutes.)

The 2024 election is unprecedented in some ways. It incorporates a rematch of the 2 oldest main presidential candidates ever, one in every of whom is a convicted felon nonetheless dealing with three different prison circumstances, and one other whose debate efficiency was so shaky lots of his supporters are hoping he’ll bow out of the race.

The election additionally comes at a wierd time for the financial system. Although the pandemic is generally within the rearview, inflation remains to be working hotter than the Federal Reserve would love. The inventory market is booming and unemployment is at a historic low, however the vibes are off: A recent survey discovered that 56% of Individuals assume the USA is in a recession — it’s not.

Because of this, pocketbook points are a serious focus for voters and candidates alike heading into November. It may be onerous to maintain up with who mentioned what and which claims are true, so we’ve put collectively a fast roundup and evaluation of remarks from Trump and Biden’s first 2024 debate.

Right here’s a fact-check of 4 massive cash subjects that might have an effect on your pockets:

Inflation

- Trump mentioned “inflation’s killing our country” and in addition instructed that meals costs have “doubled, tripled and quadrupled.”

- Biden mentioned “if Trump is re-elected, we’re likely to have a recession, and inflation is going to increasingly go up.”

The primary query of the controversy centered on inflation and the ache felt by customers, placing Biden on protection. He blamed “corporate greed” and the financial circumstances he inherited from Trump.

Nonetheless, as Trump famous, the annual inflation fee was low when Biden took workplace — 1.4% in January 2021 per the patron value index measure. Inflation peaked at 9.1% in June 2022, and it’s back down to 3.4%. Trump, for his half, exaggerated how unhealthy inflation has been. Meals costs, for instance, haven’t doubled, not to mention quadrupled: They’re up about 23% over the previous 4 years.

Whereas it’s true that inflation has soared throughout Biden’s presidency, world financial circumstances and central financial institution coverage have a better affect on inflation than the actions of any explicit nation’s chief. Additionally, inflation is hardly an issue restricted to the U.S.: Globally, headline inflation rose above 9% in 2022, based on the International Monetary Fund.

Later within the debate, Trump mentioned inflation “blew up under [Biden’s] leadership because they spent money like a bunch of people that didn’t know what they were doing.” Whereas authorities spending doubtless contributed to inflation, it’s essential to notice that each presidents superior stimulus aid in response to the pandemic. Biden has authorized $4.3 trillion of latest 10-year borrowing up to now in his presidency, which is barely about half as a lot as Trump authorized ($8.4 trillion) in his 4 years.

Will inflation climb if Trump will get one other time period? Possibly.

Biden’s declare is predicated on a letter signed Tuesday by 16 Nobel Prize winners who’re involved in regards to the financial penalties of one other Trump administration. They worry that Trump’s “fiscally irresponsible budgets” will reignite inflation. Economists additionally say {that a} Trump proposal to impose a ten% blanket tariff on imports would result in increased costs. However total it’s not possible to foretell with any certainty the place inflation is headed within the subsequent 4 years.

The financial system

- Biden mentioned “we have the fastest-growing economy in the world” and claimed “the economy was flat on its back” when he grew to become president.

- Trump mentioned “we had the greatest economy in the history of our country” throughout his presidency.

Economists typically choose the energy of the financial system underneath a president trying on the progress of actual gross home product (GDP). Actual GDP progress ranged from 2.5% to three% throughout Trump’s first three years in workplace, earlier than lowering to -2.2% in 2020. Actual GDP progress has been stronger underneath Biden, however that features 5.8% progress in 2021, which was a restoration yr.

On the financial system, Trump additionally touted the inventory market’s efficiency throughout his presidency. Nonetheless, the S&P 500’s progress underneath Biden is at 43%, in comparison with 35% for a similar interval of Trump’s time in workplace.

Biden and Trump went forwards and backwards all through the controversy on jobs, with Biden mentioning that the unemployment fee peaked at 15% underneath Trump. His level lacked the context that unemployment spiked to that degree in April 2020 on the peak of the COVID-19 shutdown.

Trump countered that “the only jobs [Biden] created are for illegal immigrants and bounce-back jobs, they’re bounced back from the COVID.” In actuality, the energy of the labor market has been spectacular underneath Biden, with jobs numbers routinely exceeding expectations regardless of forecasts of a recession. In Could, the unemployment fee was solely 4%, which is taken into account full employment. One motive the Federal Reserve has been cautious relating to rate of interest cuts is as a result of job progress has been so sturdy, as has the U.S. financial system typically.

Taxes

- Trump mentioned he led Congress to cross “the largest tax cut in history,” boasting that “nobody ever cut taxes like us” and saying Biden “needs to boost all people’s taxes by 4 occasions.”

- Biden mentioned “we have to make sure that we have a fair tax system,” repeating his declare that no person who makes underneath $400,000 “had a single penny increase in their taxes” — which is able to “be the case again” if he’s re-elected.

Trump was referring to the Tax Cuts and Jobs Act of 2017, which drastically modified the U.S. tax system. Amongst different modifications, the TCJA practically doubled the usual deduction, diminished earnings tax charges, elevated the kid tax credit score, nixed private exemptions and slashed company earnings tax charges.

TCJA was an enormous deal, to make sure. One analysis discovered the legislation diminished the typical American’s taxes by roughly $1,600, although households making between $308,000 and $733,000 benefitted probably the most. Nevertheless it was not the most important tax minimize in historical past, based on the Committee for a Responsible Federal Budget.

A lot of these TCJA provisions are set to run out on the finish of 2025, teeing up a serious battle for the subsequent president. On Thursday, debate moderators pressed Trump on his plans to increase and increase them, asking why companies and the rich ought to “pay even less in taxes than they do now” given the nation’s document debt.

In response, Trump mentioned that his tax cuts “spurred the greatest economy that we’ve ever seen just prior to COVID.” (See the financial system part above for extra particulars.)

Biden, in the meantime, vowed Thursday to “fix the tax system,” although he didn’t go into an excessive amount of element. His proposed funds floats a number of tax modifications of its personal, together with increasing the kid tax credit score and offering homebuyers with $10,000 in tax credit. These options are expensive, although.

In response to a June weblog submit from the Tax Foundation, a tax coverage nonprofit, Biden’s 2025 funds would elevate taxes by about $4.4 trillion on a gross foundation and “substantially increase marginal tax rates on investment, saving and work.” With out these modifications, the federal government would acquire $62.6 trillion, which means Biden is suggesting a tax enhance of seven% — nowhere close to the 300% tax hike Trump talked about. And Biden’s tax hikes could be paid for largely by rich Individuals: He’s repeatedly mentioned that anybody making lower than $400,000 received’t pay increased taxes.

Social Safety

- Biden mentioned Trump “wants to get rid of Social Security” and “thinks that there’s plenty to cut in Social Security.” Biden instructed a rise in payroll taxes for prime earners to maintain this system solvent.

- Trump mentioned Biden “is going to single-handedly destroy Social Security” by giving advantages to “millions of people [who] are pouring into our country.”

Social Safety is a difficult topic as a result of neither political get together needs to be the one to alienate thousands and thousands of older voters by slicing their beloved (and heavily-relied-upon) advantages. However this system is in a funding disaster: Until Congress acts, Social Safety’s belief fund reserves will run out in 2035, at which level it’ll solely have the ability to pay out 83% of advantages. A right away, across-the-board advantages minimize would ensue.

When requested throughout the debate how you can hold Social Safety solvent, Biden instructed making rich Individuals “begin to pay their fair share.” Because it stands, employers and employees each pay 6.2% of their wages as much as $168,600. This yr, millionaires reached that threshold in March.

Biden’s plan may transfer the needle. If, for example, the payroll tax have been to be utilized to earnings over $250,000 along with earnings beneath the present threshold, the belief funds would make it till 2046, based on the Congressional Budget Office.

On Thursday, Biden appeared to counsel he’d elevate payroll taxes for individuals incomes over $400,000 a yr, which might change the calculations.

Trump’s place on Social Safety has modified just lately. In March, he instructed Breitbart that he “will never do anything that will jeopardize or hurt Social Security or Medicare” — however these feedback adopted a CNBC interview during which he mentioned “there is a lot you can do in terms of entitlements in terms of cutting.” He has not put forth a proper proposal on how you can repair Social Safety.

In the course of the debate, Trump linked the Social Safety funding drawback to immigration, implying that the present president is offering advantages to “all of these people … coming in.” However based on the Social Security Administration, solely “lawfully present noncitizens of the United States who meet all eligibility requirements” are capable of qualify. As well as, individuals usually need to work for 10 years and be no less than 62 years previous to say Social Safety retirement advantages.

Extra from Cash:

Members of Congress Are Getting Rich Trading Stocks. Should That Be Illegal?

Biden Student Loan Plan Blocked: What’s Left of Debt Relief After Court Orders?

When Will the Fed Cut Interest Rates? It Might Take Longer Than Expected